I have been actively collecting points and miles via new credit card signup bonuses for four years. In that time, I have opened and closed nearly two dozen accounts. That may not sound like many compared to other bloggers, but I never open cards when I can’t meet the spending requirement for the bonus with my normal purchases. However, I have reached the point where I currently hold or have recently closed most of the cards that interest me. The solution: begin applying for cards in my wife’s name! And, this week, I have an “opportunity” to earn the signup bonus on her latest card with a single purchase!

Read MoreSince my pursuit of points and miles has resulted in many open credit card accounts, I recently began a top-to-bottom review of my overall credit card portfolio. In today's final entry in the series covering this review, I will consider the lone Barclays card products I hold.

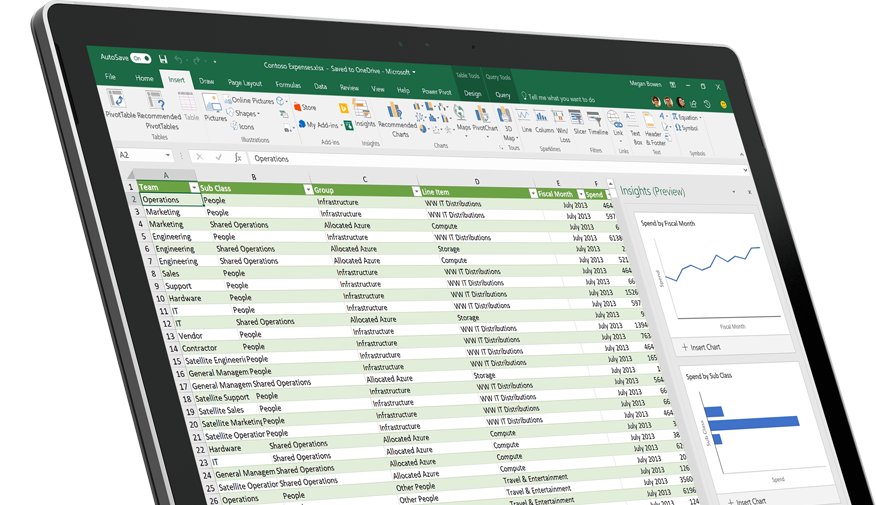

Read MoreIn October 2015, I was interviewed by the One Mile at a Time blog as part of a series on points and miles bloggers. In the comment section of that article, reader Maria asked if I had a template of the spreadsheet I use to track my credit cards. I replied that I did not have a template per se, but that I would try to post an article about my tracker. Unfortunately, I never got around to that, but since I am about to write a few articles evaluating my current credit card portfolio, I thought now would be a good time to talk about how I keep track of all my cards, their payment dates, sign-up bonus progress, and spending category bonuses.

Read MoreUntil recently I was not eligible for most Chase credit cards due to the bank's 5/24 rule. Being back in compliance, I was recently approved for a Chase Ink Business Preferred card. The sign-up bonus of 80,000 Ultimate Rewards points after spending $5,000 in the first three months of card membership is very lucrative. On top of that, the travel and telecom spending categories ensure that this will be a card I will actually use in the future.

Read MoreLast June, Hilton announced it had entered into an exclusive agreement with American Express to issue co-branded Hilton Honors credit cards. Previously, Hilton had a dual agreement with both American Express and Citibank. Until last week I held a Hilton card from Citibank, but I called and closed the account. In today’s post I want to discuss my reasoning behind this decision.

Read More